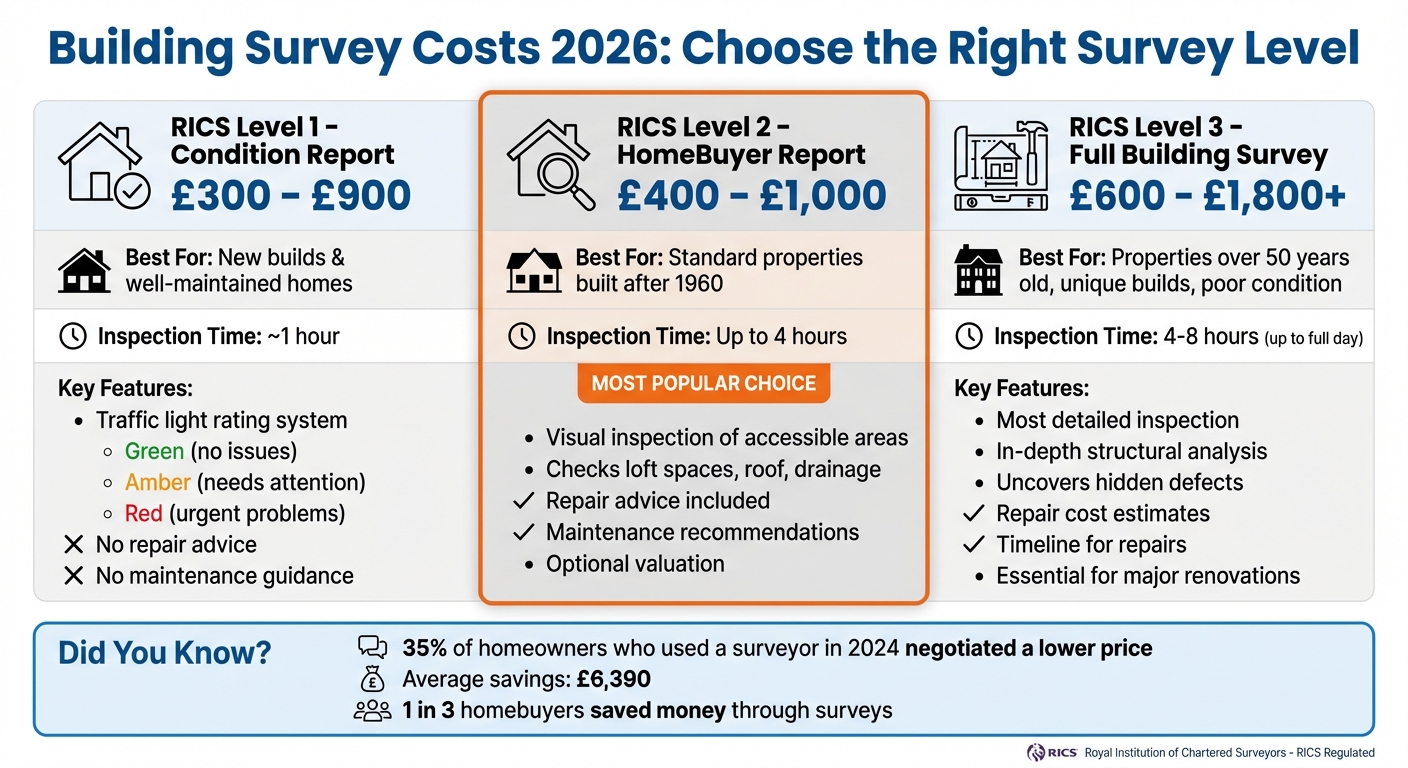

When buying a property in 2026, budgeting for a building survey is crucial. Skipping it could lead to costly surprises later. Survey costs are rising this year, with prices depending on the property type, location, and the survey level you choose. Here’s a quick breakdown:

- Level 1 (Condition Report): For new or well-maintained properties. Costs range from £300–£900.

- Level 2 (HomeBuyer Report): Ideal for standard homes built after 1960. Costs range from £400–£1,000.

- Level 3 (Full Building Survey): Best for older or complex properties. Costs range from £600–£1,800+.

Factors like property size, location, and unique features (e.g., listed status) can increase costs. Surveys often help buyers negotiate prices or request repairs, saving money in the long run. Always compare quotes from RICS-regulated surveyors to ensure you’re paying a fair price.

Investing in the right survey not only helps you avoid unexpected repair costs but also gives you a clearer picture of the property’s condition before committing.

Level 1, 2 or 3? The BEST Survey to Choose When Buying a House

Types of Building Surveys and Their Costs

Building Survey Costs 2026: Compare RICS Survey Levels and Pricing

The Royal Institution of Chartered Surveyors (RICS) breaks down property surveys into three levels, each tailored to meet specific needs based on the property’s age, condition, and the buyer’s requirements. Here’s a closer look at each survey type, along with their expected costs in 2026, to help you decide which one suits your situation best.

RICS Home Survey Level 1: Condition Report

This is the simplest and most straightforward survey option. It uses a traffic-light system to rate the property’s condition: green for areas with no issues, amber for elements needing attention, and red for urgent problems. However, it does not include advice on repairs or ongoing maintenance, making it less suitable if you’re looking for detailed recommendations. The inspection usually takes about an hour.

2026 cost range: £300–£900.

This survey is ideal for buyers considering newer or well-maintained properties where major structural concerns are unlikely.

RICS Home Survey Level 2: HomeBuyer Report

The Level 2 survey is the most commonly chosen option, especially for properties built after 1960 that are in decent condition. It involves a visual inspection of accessible areas, such as loft spaces, roof structures, and drainage chambers, and highlights visible issues like damp or structural movement. Unlike the Level 1 survey, it also provides practical advice on repairs and maintenance.

“A survey can actually save you money. If there is a problem with the house, you can renegotiate the sale price to reflect the cost of necessary repairs.” – RICS

The inspection typically takes up to four hours.

2026 cost range: £400–£1,000.

According to research conducted in 2024, 1 in 3 homebuyers who opted for a survey managed to save money, with 10% renegotiating the purchase price and 9% convincing sellers to address identified issues before completing the sale.

RICS Home Survey Level 3: Full Building Survey

This survey offers the most detailed and thorough inspection, making it essential for older properties (usually over 50 years old), unconventional builds, or homes in poor condition. It provides an in-depth structural analysis, uncovers hidden defects, and often includes repair cost estimates and timelines. If you’re planning significant renovations, such as a loft conversion or an extension, this survey is highly recommended as it assesses the structural foundations.

For complex or older properties, this survey can take between four and eight hours, sometimes extending to a full day for particularly intricate cases.

2026 cost range: £600–£1,800+ for high-value or unique homes.

| Survey Level | Best For | 2026 Expected Range | Key Features |

|---|---|---|---|

| RICS Level 1 | New builds & well-maintained homes | £300 – £900 | Traffic light ratings; no repair advice |

| RICS Level 2 | Standard properties built after 1960 | £400 – £1,000 | Visual inspection; repair advice; optional valuation |

| RICS Level 3 | Older, unique, or neglected homes | £600 – £1,800+ | In-depth structural analysis; repair cost estimates |

What Affects Building Survey Costs

Getting a clear picture of survey costs is essential for proper budgeting. Survey fees aren’t just random figures; they reflect the time, expertise, and effort required to assess your property. Let’s take a closer look at how factors like property size, location, and unique features influence these costs.

Property Size and Type

The size and type of your property play a major role in determining survey costs. Larger homes naturally take longer to inspect, which drives up fees. For instance, surveying a small flat might take just a couple of hours. On the other hand, a sprawling Victorian house could require an entire day – or even more. As noted by RICS:

“A surveyor will base their fee quotation on how much time is necessary to provide the level of service required, and to cover associated business costs such as travel time and overheads”.

Non-standard constructions, such as timber-framed houses, thatched roofs, or listed buildings, demand specialist knowledge. These unique features often mean longer inspections and higher fees. For example, while a basic survey for a standard three-bedroom semi-detached home might cost around £750–£950, more complex older properties can easily surpass £1,500.

Property Location

Where your property is located can significantly impact survey costs. Properties in London and the South East tend to have the highest fees, largely due to the area’s higher cost of living and strong demand for surveyors. Angela Kerr, Director and Editor at HomeOwners Alliance, explains:

“House surveys in London are typically more expensive but that’s because the amount you’ll pay for house surveys will depend on the value of your house. And as London has the highest average house prices in the UK this is reflected in that”.

For properties in more rural areas, surveyors might include mileage charges, which can add several hundred pounds to the overall cost. While rural properties may have lower base fees, these travel expenses can quickly add up. Opting for a surveyor based near your property can help cut down on these extra charges while ensuring they are familiar with local building styles and common regional issues.

Other Cost Factors

Older homes, especially those over 50 years old, often come with hidden problems that require a more detailed Level 2 vs Level 3 survey. Limited access to certain areas, such as roof spaces or drainage chambers, might also lead to additional visits and higher fees.

If your property has specialist features – like listed status or unusual construction materials – expect to pay more for the expertise required. Additionally, check whether the survey includes a market valuation. If not, arranging this separately can cost an extra £150–£300. You may also need additional specialist reports, such as those for asbestos or subsidence, which can add several hundred pounds to your final bill.

sbb-itb-b9291f4

Prince Surveyors: Custom Building Survey Pricing

Prince Surveyors offers personalised quotes designed to meet the unique requirements of your property. Instead of using a standard pricing model, they tailor each quote to reflect the time, effort, and expertise needed to thoroughly evaluate your home.

Highly Qualified Surveyors

Every surveyor at Prince Surveyors holds credentials from RICS (Royal Institution of Chartered Surveyors), CIOB (Chartered Institute of Building), and RPSA (Residential Property Surveyors Association). These accreditations guarantee adherence to strict professional standards and include professional indemnity insurance for added peace of mind. This personalised approach ensures that your quote is based on the specific details of your property and any particular concerns you might have.

Tailored Quotes for Your Property

The cost of a survey is influenced by several factors, including the type of survey, the complexity of the property, and additional overheads like travel time. For instance, a compact flat might only take a few hours to assess, while a Victorian terrace with unique architectural features could require a full day. Property value also affects pricing, as higher-value homes lead to increased insurance costs for surveyors, which is reflected in the final quote. If you have specific concerns about your property, sharing them with the surveyor can help further refine your quote. This personalised pricing system also accounts for local market conditions, ensuring fairness across the board.

Nationwide Service with Local Expertise

Prince Surveyors offers nationwide coverage while leveraging local knowledge to provide accurate and reliable assessments. Their surveyors are familiar with regional variations, such as common structural issues, local planning rules, and distinctive building styles. This expertise is invaluable for spotting potential problems that might be missed by someone less acquainted with the area. Travel costs are transparently included in the quote, so you’ll always know exactly what you’re paying for, no matter where your property is located.

How to Budget for Building Surveys in 2026

When planning for a building survey, it’s crucial to account for all potential costs upfront, including any extras that might arise. For context, the average cost of a house survey in the UK was £445 in 2025. However, the final price can vary depending on several factors.

How to Compare Surveyor Quotes

Start by collecting at least three quotes from local surveyors who are regulated by RICS. Avoid relying solely on recommendations from banks or estate agents, as these may come with commission fees that inflate the overall cost. Research from 2024 shows that comparing quotes can lower fees by as much as 70%.

When evaluating potential surveyors, ask for sample reports to check the level of detail they provide. Make sure the quote includes VAT, travel, and mileage costs. It’s also a good idea to confirm whether you’ll have the opportunity to discuss the findings directly with the surveyor. Carefully review the Terms of Engagement to understand what’s included in the service and identify any potential extra charges. For instance, Level 3 surveys typically don’t include a valuation unless explicitly requested. Use the quotes to decide which survey type is most appropriate for your property.

Choosing the Right Survey Level

Select a survey level that aligns with your property’s age and condition, as previously outlined. A well-chosen survey can even give you leverage to negotiate a better price.

“A thorough, accurate and impartial survey undertaken by a regulated professional is a quality service that is worth paying for.”

- RICS

As RICS points out, investing in a professional survey often pays off, either through successful price negotiations or by helping you avoid costly repairs.

Planning for Extra Costs

In addition to the survey fee, be prepared for potential follow-up expenses based on the survey’s findings. For example, if issues like damp or timber rot are identified, you may need to arrange specialist surveys, which typically cost between £150 and £300 each. Keep in mind that most Level 3 surveys don’t include valuations unless specifically requested, which could mean an additional fee.

It’s also wise to budget for contractor quotes if repairs are needed. Aim to get at least two written estimates to strengthen your position when negotiating with the seller. If you’re purchasing a new-build property, consider setting aside £300–£600 for a snagging survey to identify any defects before moving in. Finally, communicate any specific concerns to your surveyor in advance. This ensures a thorough inspection and helps you avoid the expense of follow-up visits later on.

Summary: Building Survey Costs in 2026

Understanding building survey costs can help you make informed property decisions in 2026. On average, a house survey in the UK costs £445, but prices can vary widely – from around £300 for a basic Level 1 Condition Report to upwards of £1,500 for a more in-depth Level 3 survey, typically suited for older or more complex properties. The final cost depends on factors like the property’s size, age, location, and the type of survey you choose. These variables make it essential to compare quotes carefully.

Investing in a professional survey often proves worthwhile. In 2024, 35% of homeowners who used a surveyor successfully negotiated a lower purchase price, saving an average of £6,390. This underscores the value of working with a RICS-regulated surveyor to safeguard your investment.

When budgeting, consider the benefits of a survey and plan accordingly. Get at least three quotes from qualified surveyors and factor in potential follow-up costs, such as specialist reports or contractor estimates. Choose the appropriate survey level for your property: a Level 1 survey for new builds, a Level 2 report for standard homes in good condition, or a Level 3 survey for older properties or those needing significant work.

Prince Surveyors offers tailored quotes for your property, with RICS-accredited professionals providing nationwide service and local expertise. A comprehensive survey not only equips you with the confidence to negotiate effectively but also helps you steer clear of unexpected expenses.

FAQs

How do I choose the right building survey for my property?

Choosing the right building survey depends on your property’s age, condition, and any modifications it might have undergone. For newer homes or those in good shape, a Level 1 Condition Report typically does the job. It provides a straightforward overview, focusing on major defects.

If your property is older, has been altered, or shows potential problems like damp or subsidence, you might need a more detailed survey. A Level 2 HomeBuyer Report includes a thorough visual inspection and practical advice on necessary repairs. For the most in-depth analysis, especially for older or larger properties, a Level 3 Building Survey is the best choice.

To ensure you select the right survey, consult a RICS-accredited surveyor. They’ll evaluate your property’s specifics and help match the survey to both your needs and budget.

What are the main factors that affect the cost of a building survey?

The price of a building survey can vary based on several important factors. First, the type of survey you opt for – whether it’s a HomeBuyer Report or a Full Building Survey – has a significant impact. Each type differs in detail and scope, influencing the overall cost.

Next, the size, age, and complexity of the property play a big role. Larger or older buildings often demand more time and thorough inspections, which can increase the price.

Location is another key factor. Surveyor fees can differ depending on the region, and there may be extra costs if the surveyor has to travel a considerable distance to reach the property. Being aware of these elements can help you plan your budget wisely and make sure you’re spending your money effectively.

Why should you compare quotes from different surveyors?

Comparing quotes from various surveyors is a smart way to make sure you’re getting good value for your money while securing the level of service that matches your needs. It helps you see how fees and the scope of work stack up, reducing the risk of hidden charges or paying more than necessary.

Looking at multiple quotes also gives you a better sense of what each survey includes – whether it’s the depth of the inspection or the type of report provided. This way, you can pick a surveyor whose skills and pricing fit both your property requirements and your budget.