When buying a home, choosing between a house survey level 2 or 3 can save you from unexpected repair costs. The Homebuyer Survey (Level 2) is a visual inspection suitable for standard, newer homes in good condition, while the Full Building Survey (Level 3) offers a deeper, hands-on inspection for older, larger, or poorly maintained properties.

Key Differences:

- Homebuyer Survey: Ideal for properties built post-1880, costs £400–£1,000, uses a traffic light system for defects, and focuses on visible issues.

- Full Building Survey: Designed for older or unique homes, costs £600–£1,500+, includes detailed defect analysis, repair costs, and checks under floorboards and in attics.

Quick Tip: If your property is older, has unusual features, or needs renovation, go for a Level 3 survey. For newer homes in good shape, a Level 2 survey should suffice. Both can help you renegotiate the price or plan repairs before buying.

HomeBuyer Survey Vs Building Survey – What are the differences between these two RICS Home Surveys?

What is a Homebuyer Survey (RICS Home Survey Level 2)?

The RICS Home Survey Level 2, previously known as the Homebuyer Report, offers a non-intrusive visual inspection designed for typical properties in reasonable condition. It’s a popular choice among UK property buyers, striking a balance between affordability and detail by focusing only on visible defects. The inspection itself usually takes between 90 minutes and 4 hours, with the final report delivered within 5 working days. This report, often exceeding 25 pages, provides a detailed overview of the property’s condition. Angela Kerr from HomeOwners Alliance explains:

“RICS Homebuyer Surveys are a mid-level survey popular with most people buying a conventional property in a reasonable condition”.

Let’s take a closer look at what this survey covers.

What the Survey Includes

The Level 2 survey uses a straightforward ‘traffic light’ system to highlight repair priorities. Here’s how it works:

- Condition Rating 1 (green): No repairs are currently needed.

- Condition Rating 2 (amber): Repairs are required, but they’re not urgent.

- Condition Rating 3 (red): Serious issues that need immediate attention or further investigation.

This survey examines both the interior (like ceilings, walls, and bathrooms) and exterior (such as roofs and gutters) for potential issues, including damp, timber rot, or pest infestations. If you want added insights, you can choose a version of the survey that includes a formal market valuation and an insurance reinstatement figure, which estimates the cost of rebuilding the property.

The report also provides expert advice on necessary repairs and ongoing maintenance, ensuring you know what needs fixing and when. If you’re concerned about specific areas – like central heating, roofing, or damp – make sure to mention these to the surveyor beforehand. Should the survey flag any Condition Rating 3 issues, it’s wise to commission a specialist survey before moving forward with the purchase.

Best Property Types for This Survey

This survey is ideal for conventional houses, flats, or bungalows built after the late Victorian era (around 1880). However, it’s not suitable for older properties (pre-1880), thatched cottages, timber-framed buildings, or homes requiring substantial renovations. Typically priced between £400 and £1,000 – about 60% of the cost of a Level 3 building survey – it’s best suited for homes in standard condition.

What is a Full Building Survey (RICS Home Survey Level 3)?

The RICS Home Survey Level 3 is the most thorough type of property inspection you can get. Unlike the Level 2 survey, this one digs deeper – literally. It involves an intrusive inspection that includes checking attics, lifting floorboards, and identifying hidden defects that might otherwise go unnoticed. This process can take up to 8 hours, which is twice as long as a Level 2 survey, and provides a detailed analysis of the property’s structure, construction, and materials. According to RICS:

“Choose an RICS Level 3 Home Survey if you’re dealing with a large, older or run-down property, a building that is unusual or altered, or if you’re planning major works.”

This type of survey is especially important for properties with potential hidden issues, such as older homes prone to structural problems like subsidence, roof sagging, or even invasive threats like Japanese Knotweed. While the cost is over £1,000, it includes a tailored report that goes far beyond what a Level 2 survey offers. If your property has complex concerns, this survey ensures no critical structural issues are missed.

What the Survey Includes

A Level 3 survey doesn’t just stop at identifying issues – it digs into the causes and provides actionable insights. Unlike the traffic light system in a Level 2 survey, this report offers an in-depth analysis of defects, their origins, and how the materials in the property are likely to perform over time. The surveyor carefully examines all accessible areas of the property, identifying both visible issues and potential hidden risks.

The report includes detailed repair recommendations, complete with estimated costs. It also explains the consequences of leaving these issues unaddressed, which can be a powerful tool during negotiations. For instance, buyers might use these cost estimates to renegotiate the purchase price or request the seller to carry out repairs before the exchange of contracts.

However, it’s worth noting that a Level 3 survey doesn’t automatically come with a market valuation or an insurance reinstatement figure. These can often be added as extra services if your mortgage provider requires them.

This level of detail is crucial when dealing with properties that have unique or advanced structural challenges.

Best Property Types for This Survey

A Level 3 survey is tailored for properties that don’t fit the “standard” mould. It’s ideal for homes in poor condition, those that have been neglected, or older properties – particularly those over 50 years old. It’s also a must for listed buildings, properties with unusual construction methods, timber-framed homes, or buildings that have undergone significant alterations.

If you’re planning major renovations or the property shows signs of serious issues – like cracked masonry, sagging roofs, or damp – this survey can be a lifesaver. Its more intrusive nature allows surveyors to uncover potential deal-breakers early on. For example, they can spot signs of subsidence or identify invasive species like Japanese Knotweed, which can take years to remove and cause extensive damage to walls and drains.

This survey is your best bet when you need a thorough understanding of a property’s condition before making a significant investment.

sbb-itb-b9291f4

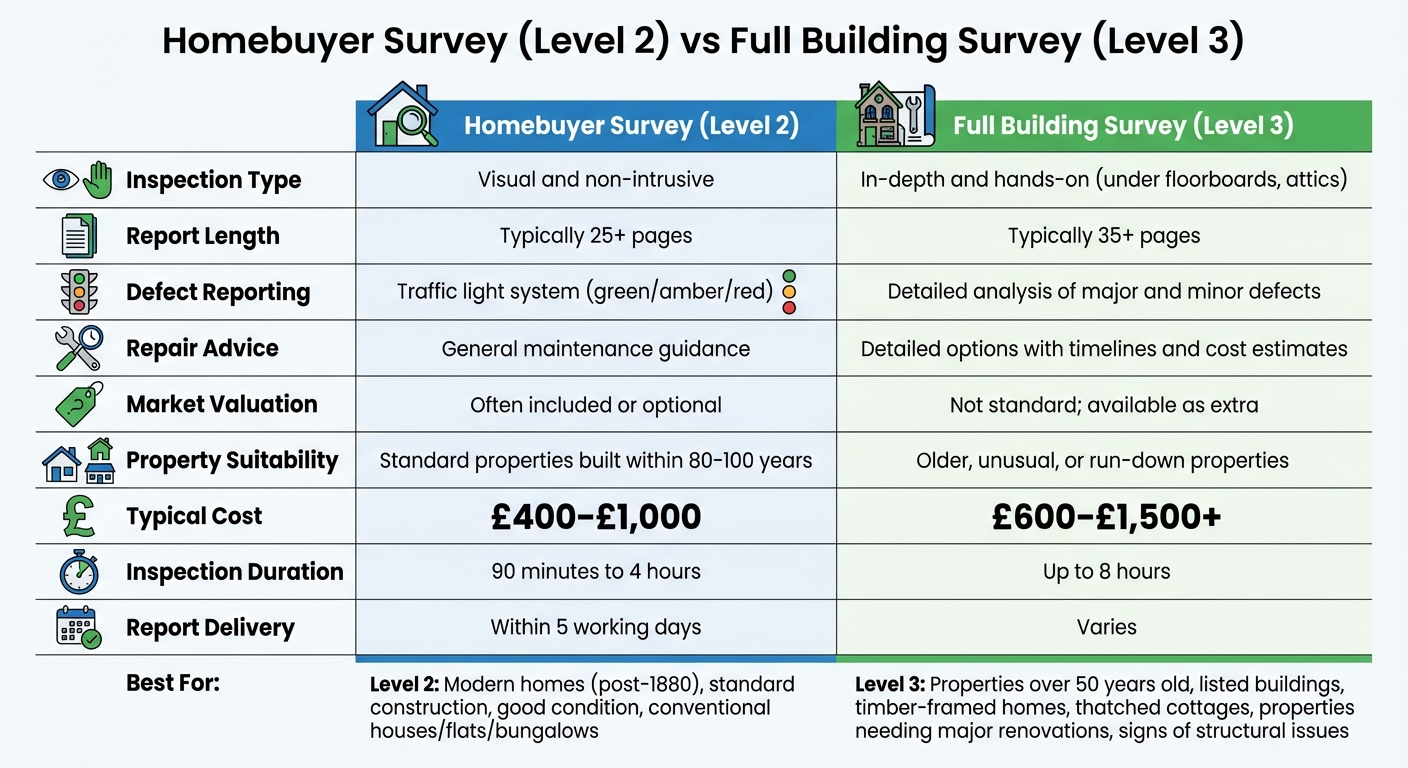

Main Differences Between the Two Surveys

Homebuyer Survey vs Full Building Survey Comparison Guide

The main distinction between Level 2 and Level 3 surveys lies in the depth of inspection rather than just the cost. A Homebuyer Survey (Level 2) involves a visual, non-intrusive inspection. Surveyors check accessible areas without moving furniture or lifting floorboards, using a traffic light system to highlight defects. On the other hand, a Full Building Survey (Level 3) is far more detailed, involving a hands-on approach that includes examining under floorboards and inspecting the attic. The time required for the inspection depends on the survey type. These differences directly impact the structure and detail of the reports, as well as the cost, shaping how each survey can guide your property decisions.

The reports themselves vary significantly in detail. Level 2 reports summarise issues using the traffic light system, while Level 3 reports provide a thorough structural analysis. These detailed reports explore the causes of defects, potential solutions, and the risks of delaying repairs. Additionally, Level 3 surveys often include repair cost estimates, which can be useful during price negotiations. As the Royal Institution of Chartered Surveyors (RICS) notes, “A thorough, accurate and impartial survey undertaken by a regulated professional is a quality service that is worth paying for”. Choosing between the two depends on factors like the property’s age, condition, and construction type.

Side-by-Side Comparison Table

| Feature | Homebuyer Survey (Level 2) | Full Building Survey (Level 3) |

|---|---|---|

| Inspection Type | Visual and non-intrusive | In-depth and hands-on (e.g. under floorboards) |

| Report Length | Typically 25+ pages | Typically 35+ pages |

| Defect Reporting | Uses a traffic light system | Detailed analysis of major and minor defects |

| Repair Advice | General maintenance guidance | Detailed options with timelines and cost estimates |

| Market Valuation | Often included or optional | Not standard; available as an extra |

| Property Suitability | Best for standard properties built within 80–100 years | Ideal for older, unusual, or run-down properties |

| Typical Cost | £400–£1,000 | £600–£1,500+ |

How to Choose Based on Your Property

Knowing the differences between these surveys can help you match the right one to your property’s needs. If you’re purchasing a conventional house, flat, or bungalow built from standard materials in the last 80–100 years, and it appears to be in good shape, a Homebuyer Survey might be enough. However, for older properties – especially those built 50 to 80 years ago – or homes with unique features like thatched roofs or timber frames, a Full Building Survey is a better choice. This is particularly true if there are signs of potential issues, such as cracked masonry, sagging roofs, or damp patches.

The type of construction also plays a role. Larger properties with five or more bedrooms, listed buildings, timber-framed homes, or properties in conservation areas typically require the detailed inspection provided by a Level 3 survey. While a Homebuyer Survey may suffice for straightforward properties, opting for a Full Building Survey can reveal hidden structural problems that might otherwise go unnoticed.

Survey Costs and Return on Investment

UK Survey Pricing

In the UK, the cost of property surveys varies depending on the type and depth of inspection. A Homebuyer Survey (Level 2) typically costs between £400 and £1,000, while a Full Building Survey (Level 3) ranges from £630 to £1,500 or more. The price difference reflects the level of detail provided – Level 2 surveys generally cost about 60% of a Level 3 survey. Factors like property size, type, and location also influence pricing. These expenses, however, are a relatively small price to pay when compared to the potential savings on major repairs down the line.

How the Right Survey Saves Money

Choosing the right survey isn’t just about ticking a box – it can save you a significant amount of money in the long run. Surveys often lead to actionable insights: 30% of buyers use the findings to renegotiate the purchase price or request repairs, while 11% of those who skip a survey later encounter unexpected problems.

The financial benefits are clear. Take this example from Esther Shaw, a Money & Property Journalist:

“If you find for example it needs £15,000 of roof repairs, it is reasonable to ask for £15,000 off the price”.

Imagine spending £600 on a Level 2 survey that uncovers £10,000 worth of repairs. That information could allow you to negotiate a price reduction of the same amount, making the survey a smart investment with high returns.

Surveys also help buyers avoid properties with major issues like subsidence, severe damp, or structural movement – problems that could turn a dream home into a financial nightmare. Angela Kerr, Director and Editor at HomeOwners Alliance, puts it succinctly:

“Considering the amount of money you are spending on the house, paying a few hundred pounds on getting an expert’s advice seems like a good investment”.

Beyond identifying immediate issues, surveys provide repair timelines and maintenance advice, helping you plan for future expenses. It’s worth noting that mortgage valuations are primarily for the lender’s benefit and might overlook costly defects. By opting for the right survey, you not only safeguard your investment but also gain valuable leverage in price negotiations.

Conclusion: Choosing Your Survey with Prince Surveyors

Summary of Survey Selection

Deciding between a Level 2 and Level 3 survey depends on factors like your property’s age, condition, and future plans. A Level 2 survey is ideal for standard properties in reasonable condition, while a Level 3 survey is better suited for older homes, unique designs, or properties requiring renovation. While Level 2 surveys are generally more budget-friendly, the detailed insights from a Level 3 survey can justify the higher cost, especially when it comes to repair advice and potential savings during price negotiations.

With these options laid out, you’re now better equipped to choose the survey that fits your needs. Let’s see how Prince Surveyors can assist you in this process.

Prince Surveyors’ Survey Services

Prince Surveyors provides tailored survey solutions for all property types, offering both Level 2 and Level 3 surveys carried out by RICS-accredited professionals. Whether it’s a modern flat in London or a charming Victorian terrace in the Midlands, the team ensures each inspection is customised to suit your property’s unique characteristics.

FAQs

How do I decide between a Homebuyer Survey and a Full Building Survey?

Choosing between a Homebuyer Survey (Level 2) and a Full Building Survey (Level 3) comes down to a few important considerations:

- Age and style of the property: A Homebuyer Survey works well for standard properties that are less than 80–100 years old and haven’t undergone major alterations. However, for older homes, period properties, or those with unique features like timber frames or thatched roofs, a Full Building Survey is a better choice. It provides a more thorough examination of potential issues.

- Plans for renovations: If you’re planning significant structural changes, a Full Building Survey offers detailed insights and advice to guide your renovations. On the other hand, for straightforward purchases with no major works in mind, a Homebuyer Survey often does the job.

- Budget and level of detail needed: The Homebuyer Survey is a cost-effective option and uses a straightforward traffic-light system to highlight visible problems. Meanwhile, the Full Building Survey is more detailed, exploring the causes of defects and providing tailored advice. It’s a better fit for more complex or high-value properties.

Taking these points into account will help you choose the survey that aligns with your property and your plans, ensuring you go into the purchase with confidence.

Can a property survey help me negotiate a lower purchase price?

A property survey can be a powerful tool when negotiating the price of a home. It highlights structural problems, maintenance needs, or other defects, giving you a detailed understanding of the property’s condition. Armed with this information, you can present the estimated repair costs as a basis to negotiate a lower price or request that the seller resolves the issues before the sale is finalised.

This approach helps ensure you’re making a well-informed choice and not paying more than the property is worth, especially if it requires extensive repairs.

What risks do you face if you skip a property survey before buying a home?

Skipping a property survey might seem like a way to save time or money, but it can leave you vulnerable to problems that aren’t obvious during a typical viewing. Without the expertise of a RICS-qualified surveyor, you could overlook major issues like structural weaknesses, damp, faulty drainage, or other potentially expensive repairs waiting to surface. It’s worth noting that a lender’s valuation is solely focused on determining the property’s worth for mortgage purposes – it doesn’t assess the actual condition of the home.

A survey isn’t just about identifying problems; it’s also a powerful bargaining tool. If the report reveals significant issues, you may have the chance to renegotiate the price or even rethink your purchase altogether. Without this insight, you risk paying more than the property is worth or being blindsided by costly repairs after moving in. Considering the scale of the investment, a survey offers reassurance that your new home is not only a good deal but also a safe and secure place to live.