Desktop House Valuation: Your Complete Guide to Modern Property Assessment in 2025

Picture this: you need to know your property’s value, but you don’t want to wait weeks for a traditional surveyor or pay hefty fees for a full appraisal. Enter desktop house valuation – the digital revolution that’s transforming how property values are determined in 2025. This innovative approach combines cutting-edge technology with professional expertise to deliver accurate property assessments without anyone stepping foot on your property.

Key Takeaways

• Desktop house valuation uses digital tools and data analysis to assess property values remotely, offering faster and more cost-effective alternatives to traditional methods

• Accuracy rates of desktop valuations have improved significantly, with modern systems achieving 85-95% accuracy compared to physical inspections

• Time efficiency is a major advantage, with desktop valuations typically completed within 24-48 hours versus weeks for traditional surveys

• Cost savings can be substantial, with desktop valuations often costing 50-70% less than full property surveys

• Technology integration includes satellite imagery, AI algorithms, and comprehensive property databases for enhanced precision

Understanding Desktop House Valuation: The Digital Revolution

Desktop house valuation represents a fundamental shift in how property professionals assess real estate values. Unlike traditional methods that require physical site visits, this modern approach leverages digital technology, comprehensive databases, and sophisticated algorithms to determine property worth from a remote location.

The process involves analyzing multiple data sources including:

- 📊 Recent comparable sales data

- 🏠 Property characteristics and specifications

- 📍 Location-specific market trends

- 🛰️ Satellite and aerial imagery

- 📈 Historical price movements

- 🏘️ Neighborhood demographics

Professional surveyors and valuers use specialized software platforms that aggregate this information, applying their expertise to interpret the data and produce accurate valuations. This method has gained significant traction among property professionals who need quick, reliable assessments for various purposes.

The Technology Behind Desktop Valuations

Modern desktop valuation systems employ artificial intelligence and machine learning algorithms to process vast amounts of property data. These systems can:

- Analyze thousands of comparable properties instantly

- Identify market patterns that human assessors might miss

- Adjust valuations based on real-time market conditions

- Factor in unique property features through advanced data modeling

The sophistication of these tools means that desktop valuations are no longer just rough estimates – they’re becoming increasingly precise alternatives to traditional assessment methods.

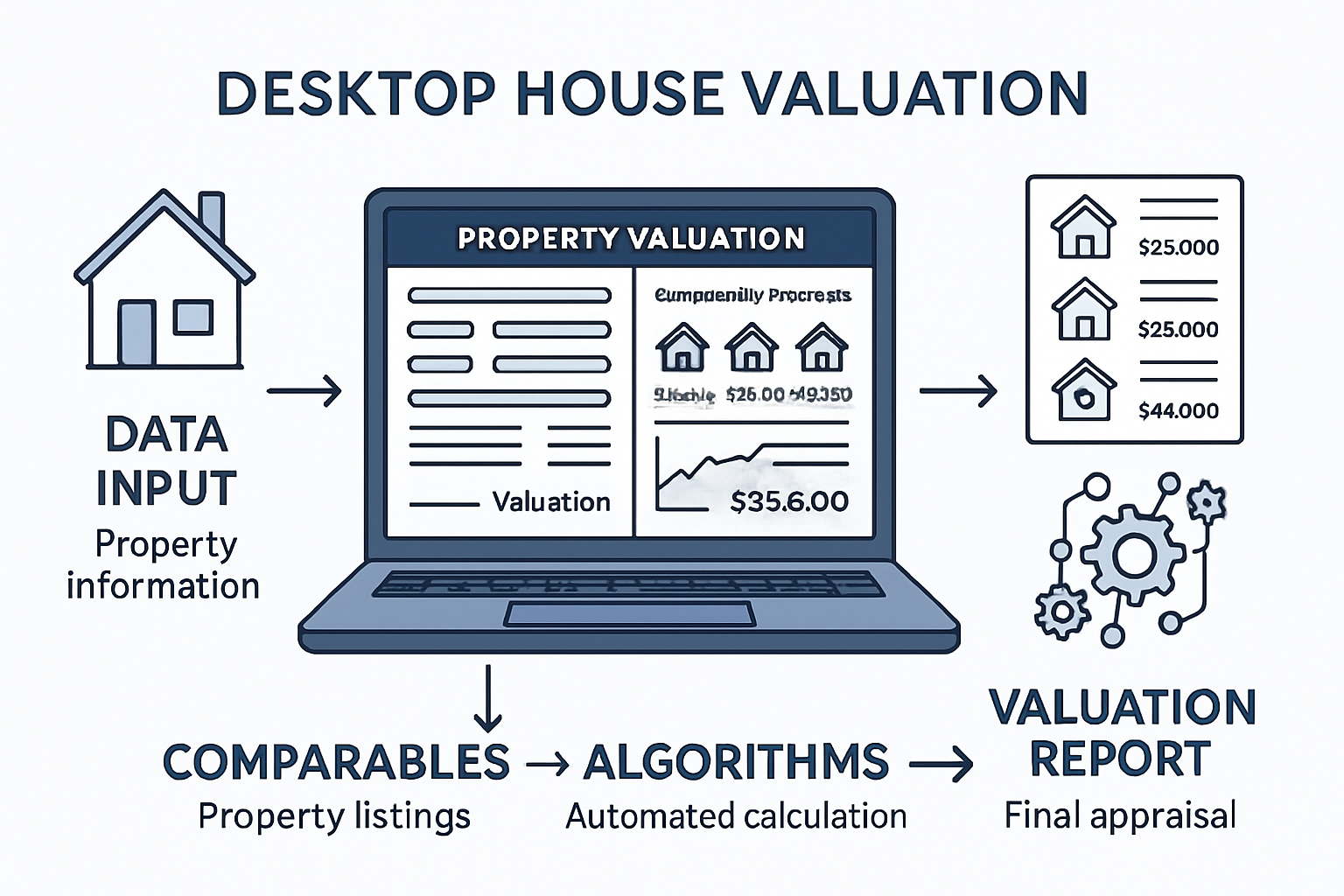

How Desktop House Valuation Works: A Step-by-Step Process

The desktop valuation process follows a systematic approach that combines automated data analysis with professional judgment. Understanding this process helps property owners appreciate the thoroughness and reliability of modern desktop assessments.

Initial Data Collection

The valuation begins with gathering comprehensive information about the subject property:

- Property Details: Address, size, type, age, and construction materials

- Planning Records: Building permits, extensions, and modifications

- Market Data: Recent sales in the area and current listings

- Geographic Information: Location factors, transport links, amenities

Comparative Market Analysis

Valuers then conduct a detailed comparative market analysis (CMA) using:

| Analysis Factor | Weight in Valuation | Data Sources |

|---|---|---|

| Recent Sales | 40-50% | Land Registry, MLS data |

| Property Features | 25-30% | Planning records, imagery |

| Location Factors | 15-20% | Geographic databases |

| Market Trends | 5-10% | Economic indicators |

Technology-Enhanced Assessment

Modern desktop valuations incorporate several technological tools:

- Aerial Photography: High-resolution images show property condition and features

- Street View Technology: Virtual property inspections identify external characteristics

- GIS Mapping: Geographic information systems provide location context

- Automated Valuation Models (AVMs): AI-powered systems process data patterns

Professional valuers review and interpret this automated analysis, applying their expertise to ensure accuracy and account for factors that technology might miss. This human oversight is crucial for maintaining professional surveying standards.

Quality Assurance and Validation

The final step involves rigorous quality checks:

- ✅ Cross-referencing multiple data sources

- ✅ Peer review by experienced professionals

- ✅ Market validation against recent transactions

- ✅ Confidence scoring to indicate reliability levels

Benefits and Limitations of Desktop House Valuation

Desktop house valuation offers compelling advantages while also having certain limitations that property owners should understand before choosing this assessment method.

Key Benefits

Speed and Efficiency ⚡

Desktop valuations can be completed in 24-48 hours, compared to 1-2 weeks for traditional surveys. This rapid turnaround is invaluable for:

- Time-sensitive transactions

- Mortgage applications with tight deadlines

- Portfolio assessments for investors

- Quick market evaluations

Cost-Effectiveness 💰

Significant cost savings make desktop valuations attractive:

- 50-70% lower fees than full surveys

- No travel expenses for surveyors

- Reduced administrative overhead

- Bulk pricing for multiple properties

Convenience and Accessibility 🏠

The remote nature eliminates common barriers:

- No need to arrange property access

- Works for vacant or occupied properties

- Available for properties in any location

- Minimal disruption to occupants

Comprehensive Data Analysis 📊

Modern systems access vast databases that individual surveyors couldn’t manually review:

- Thousands of comparable properties

- Real-time market data

- Historical trend analysis

- Geographic and demographic factors

Important Limitations

Reduced Physical Inspection 🔍

Desktop valuations cannot identify:

- Internal property conditions

- Hidden structural issues

- Recent renovations not yet recorded

- Unique features requiring physical assessment

Market Condition Dependencies 📈

Accuracy can be affected by:

- Rapidly changing markets

- Limited comparable sales data

- Unique or unusual properties

- Properties in emerging areas

Technology Limitations 🖥️

Current systems may struggle with:

- Properties with complex layouts

- Historic or listed buildings

- Properties with significant modifications

- Areas with limited digital coverage

Understanding when desktop valuations are most appropriate helps property owners make informed decisions. For comprehensive property assessments that identify potential issues, traditional building surveys remain essential.

When to Choose Desktop House Valuation vs Traditional Methods

Selecting the right valuation method depends on your specific needs, timeline, and the purpose of the assessment. Understanding these factors helps ensure you get the most appropriate and valuable property evaluation.

Ideal Scenarios for Desktop Valuation

Mortgage Applications and Refinancing 🏦

Many lenders now accept desktop valuations for:

- Standard residential properties

- Refinancing existing mortgages

- Properties in well-established areas

- Loan-to-value ratios below 80%

Investment Portfolio Management 📊

Property investors benefit from desktop valuations for:

- Regular portfolio monitoring

- Market trend analysis

- Quick acquisition decisions

- Insurance valuation updates

Estate Planning and Tax Purposes 📋

Desktop valuations work well for:

- Inheritance tax calculations

- Divorce settlements

- Asset division planning

- Annual portfolio reviews

When Traditional Surveys Are Essential

Property Purchases 🏠

Full surveys remain crucial when:

- Buying older properties (pre-1970s)

- Purchasing listed or historic buildings

- Dealing with unusual construction types

- Properties showing signs of structural issues

Professional surveyors can identify common defects in older homes that desktop valuations might miss.

Complex Property Types 🏢

Traditional methods are better for:

- Commercial properties

- Mixed-use developments

- Properties with significant modifications

- Unique architectural features

Legal and Dispute Resolution ⚖️

Court proceedings and disputes require:

- Detailed inspection reports

- Professional site visits

- Expert witness testimony

- Comprehensive condition assessments

Hybrid Approaches

Many property professionals now recommend combined strategies:

- Initial Desktop Assessment: Quick market evaluation

- Targeted Physical Inspection: Focus on specific concerns

- Final Valuation Report: Comprehensive analysis

This approach balances speed and cost-effectiveness with thoroughness and accuracy.

The Future of Desktop House Valuation Technology

The desktop valuation industry continues evolving rapidly, with emerging technologies promising even greater accuracy and functionality. Understanding these developments helps property professionals and owners prepare for the future of property assessment.

Artificial Intelligence Advancements

Machine Learning Improvements 🤖

Next-generation AI systems will offer:

- Enhanced pattern recognition in property data

- Predictive modeling for future value trends

- Automated adjustment for market volatility

- Improved accuracy for unique property types

Natural Language Processing 💬

Advanced systems will analyze:

- Property descriptions and marketing materials

- Planning application documents

- Local news and development announcements

- Social media sentiment about neighborhoods

Enhanced Visual Technology

Drone Integration 🚁

Unmanned aerial vehicles provide:

- High-resolution property imagery

- 3D modeling capabilities

- Roof and exterior condition assessment

- Neighborhood context visualization

Virtual Reality Applications 🥽

VR technology enables:

- Remote property “walkthroughs”

- Detailed interior space analysis

- Interactive property presentations

- Enhanced buyer engagement

Blockchain and Data Security

Transparent Record Keeping 🔐

Blockchain technology offers:

- Immutable valuation records

- Enhanced data verification

- Reduced fraud potential

- Streamlined transaction processes

Smart Contracts 📝

Automated systems will enable:

- Instant valuation updates

- Triggered reassessments based on market changes

- Automated insurance adjustments

- Seamless mortgage processing

Integration with IoT and Smart Homes

Real-Time Property Data 📱

Internet of Things devices provide:

- Continuous property monitoring

- Energy efficiency metrics

- Maintenance requirement tracking

- Security and safety assessments

This technological evolution will make desktop valuations increasingly sophisticated while maintaining their core advantages of speed and cost-effectiveness. Property professionals who embrace these innovations will be better positioned to serve their clients’ evolving needs.

For property owners considering their options, staying informed about these developments ensures they can make the best decisions about property valuation methods.

Choosing the Right Desktop Valuation Provider

Selecting a qualified and reputable desktop valuation provider is crucial for obtaining accurate, reliable assessments. The quality of the valuation depends heavily on the provider’s expertise, technology, and professional standards.

Essential Qualifications and Credentials

Professional Memberships 🏛️

Look for providers with:

- RICS (Royal Institution of Chartered Surveyors) membership

- ISVA (Incorporated Society of Valuers and Auctioneers) certification

- NAEA (National Association of Estate Agents) accreditation

- Local professional body recognition

Experience and Specialization 📚

Evaluate providers based on:

- Years of experience in property valuation

- Specialization in your property type

- Local market knowledge

- Track record of accuracy

Technology and Methodology 💻

Assess their technological capabilities:

- Advanced valuation software platforms

- Access to comprehensive databases

- Quality of data sources

- Validation and quality control processes

Questions to Ask Potential Providers

About Their Process ❓

- What data sources do they use?

- How do they validate their valuations?

- What is their typical turnaround time?

- How do they handle unusual or complex properties?

About Accuracy and Reliability ✅

- What is their accuracy rate compared to physical valuations?

- Do they provide confidence levels with their assessments?

- How do they handle market volatility?

- What happens if the valuation proves inaccurate?

About Professional Standards 📋

- Are they regulated by professional bodies?

- Do they carry professional indemnity insurance?

- Can they provide references from recent clients?

- What are their complaint resolution procedures?

Red Flags to Avoid

Unrealistic Promises ⚠️

Be wary of providers who:

- Guarantee specific valuations before assessment

- Promise unrealistically fast turnarounds

- Claim 100% accuracy rates

- Offer significantly below-market pricing

Lack of Transparency 🚫

Avoid providers who:

- Won’t explain their methodology

- Don’t provide detailed reports

- Refuse to discuss their qualifications

- Have no clear complaints procedure

Working with established professionals like those at Prince Surveyors ensures you receive high-quality, reliable desktop valuations backed by professional expertise and industry standards.

Cost Considerations and Value Proposition

Understanding the financial aspects of desktop house valuation helps property owners make informed decisions about when and how to use these services effectively.

Typical Cost Structure

Standard Desktop Valuations 💷

- Residential properties: £150-£400

- Commercial properties: £300-£800

- Portfolio assessments: £100-£250 per property

- Rush services: 25-50% premium

Factors Affecting Pricing 📊

- Property value and complexity

- Geographic location

- Urgency of requirement

- Provider’s reputation and qualifications

- Additional services required

Comparing Value Propositions

Desktop vs Traditional Survey Costs 💰

| Service Type | Typical Cost | Timeframe | Best For |

|---|---|---|---|

| Desktop Valuation | £200-£400 | 1-2 days | Quick assessments |

| Homebuyer Survey | £400-£800 | 5-10 days | Standard purchases |

| Building Survey | £600-£1,500 | 7-14 days | Older/complex properties |

Return on Investment 📈

Desktop valuations provide value through:

- Time savings: Faster decision-making

- Cost efficiency: Lower upfront expenses

- Market insights: Regular monitoring capabilities

- Risk management: Early identification of value changes

Hidden Costs to Consider

Additional Services 📋

- Rush delivery fees

- Detailed report supplements

- Follow-up consultations

- Multiple property discounts

Potential Follow-Up Costs 🔄

- Traditional survey if issues identified

- Legal fees for complex valuations

- Insurance adjustments

- Professional advice consultations

Understanding these cost considerations helps property owners budget effectively and choose the most appropriate valuation method for their specific needs. For those requiring comprehensive property assessments, exploring building survey options may provide better long-term value.

Conclusion

Desktop house valuation has emerged as a powerful tool in the modern property professional’s toolkit, offering unprecedented speed, convenience, and cost-effectiveness for property assessments in 2025. This technology-driven approach successfully bridges the gap between traditional surveying methods and the fast-paced demands of today’s property market.

The key strengths of desktop valuations – rapid turnaround times, significant cost savings, and comprehensive data analysis – make them ideal for mortgage applications, investment decisions, and regular portfolio monitoring. However, understanding their limitations ensures they’re used appropriately, particularly when dealing with older properties, complex structures, or situations requiring detailed condition assessments.

Your Next Steps:

- Assess your specific needs – determine whether speed or detailed inspection is your priority

- Research qualified providers – ensure they have proper credentials and technology

- Consider hybrid approaches – combine desktop assessments with targeted inspections when needed

- Stay informed about technological developments that continue improving accuracy and functionality

- Consult professionals when uncertain about the best approach for your situation

As technology continues advancing, desktop house valuations will become increasingly sophisticated while maintaining their core advantages. Property owners who understand when and how to use these services effectively will be better positioned to make informed decisions in an ever-evolving real estate market.

Whether you’re a first-time buyer, seasoned investor, or property professional, desktop house valuation offers a valuable tool for navigating today’s dynamic property landscape. The key lies in choosing the right approach for your specific circumstances and working with qualified professionals who can deliver accurate, reliable assessments that meet your needs.